Blog

The Difficult Birth of the 4680 Battery: Only Tesla Dares Make Batteries This Way

2025-08-17 | Calvin

In 2006 Elon Musk unveiled a grand vision: build ever-cheaper electric cars to replace internal-combustion vehicles and accelerate the world’s shift to sustainable energy.

China is rapidly closing in on that goal. Average prices for new energy vehicles here have fallen from over ¥200,000 last year to below ¥180,000, roughly on par with gasoline cars — and prices are expected to keep sliding next year. New automakers and brands that once targeted the ¥250,000–¥400,000 market are rolling out cheaper models. The China Passenger Car Association estimates that in 2024, 42 out of every 100 cars sold in China will be new energy vehicles.

Yet Tesla, the company that helped start this shift, is conspicuously absent. At least for the next 18 months, Tesla won’t launch a brand-new model in the Chinese market. Its Model 3 and Model Y no longer enjoy the price advantage they had when first released. Tesla’s only new global model, the Cybertruck, will see production of just 125,000 units in 2024 and will be delivered mainly in the U.S. That futuristic pickup starts at roughly ¥430,000 in China — about 1.5 times the price announced back in 2019.

Tesla’s earlier announcement of a mass-market car priced under ¥150,000 won’t reach volume production until at least Q2 2025. By then the Model 3 will have been on sale for eight years and the Model Y for five, with only a single facelift that left the overall shape unchanged.

One major cause of this five-year product gap is the long delay in mass producing the 4680 battery.

From Announcement to Small-Scale Production: the 4680 Timeline

Tesla announced the 4680 cell in 2020. Early on, Musk argued that battery manufacturing was far too inefficient and that Tesla could reinvent the production process, ditch conventional practices, and cut costs by 50%.

The 4680 was supposed to be in mass production in 2021, but only reached small-scale production around mid-2024. Tesla’s Texas factory made just 10 million 4680 cells in the past four months — enough for about 12,000 Cybertrucks.

We’ve learned that in the second half of this year Tesla began outsourcing electrode foil work to Chinese battery firms to meet production needs. By Q2 next year Panasonic is expected to start supplying 4680 cells to Tesla, but that capacity will only be enough for roughly 60,000 vehicles.

First Principles — Tesla’s Once-Reliable Playbook

From the Roadster to the Model 3 and then the Model Y, Tesla has repeatedly used “first-principles” thinking: question long-accepted assumptions, trace problems back to basics, and then use physics to find simpler, cheaper solutions — often achieving what industry experts called impossible. The 4680 cell is an extension of that approach.

In Musk and elsewhere, the first-principles method is described again and again. At SpaceX, Musk challenged the orthodoxy and used cheaper stainless steel instead of carbon fiber to make rockets, eventually building a Starship that reached space for just 2% of the cost of NASA’s lunar program.

Tesla and Musk’s other tech ventures often find new paths by returning to fundamentals and proving conventional wisdom wrong. But with the 4680, Tesla’s approach has hit stubborn obstacles. This cell determines the production capacity and pricing of Tesla’s next-generation cars, yet its mass-production timing and performance fell short of the original goals. That’s the flip side of first-principles thinking: when innovation is complex, deriving everything from first principles is often just the start of a long, difficult journey.

Reinventing the Battery — and the Factory

Musk once proposed an “idiocy index”: the price of a part divided by the cost of the raw materials needed to make it. The bigger that number, the more “idiotic” the part — meaning too many middle steps or poor manufacturing efficiency.

Whenever Tesla finds a component with a high idiocy index, it rethinks the process and changes manufacturing to push that number closer to 1. Musk wants a car’s manufacturing cost to approach the sum of its raw materials: steel, aluminum, silicon, lithium, and so on.

After checking commodity prices at the London Metal Exchange in 2007, Musk calculated the battery’s idiocy index was about 7: the material cost for one kWh of battery (lithium, cobalt, nickel) was around $82, while lithium batteries sold for over $600 per kWh — the result of decades of work by Sony, Panasonic and others.

Tesla partnered with Panasonic in 2014 to build a “gigafactory” to cut battery costs. But by 2020 the battery idiocy index was still about 2, while Tesla’s car-level idiocy index had dropped below 1.5. To keep margins, Tesla needed to sell cars at around $40,000 (roughly ¥300,000), which Musk still thought wasn’t cheap enough.

So in 2020 Tesla announced plans for a low-price EV priced around $25,000 (about ¥150,000 at the time) to enter the mainstream market and compete with best-sellers like the Toyota Corolla. A full battery cost-reduction plan underpinned this goal. Starting in 2018, Tesla launched a project codenamed “Roadrunner” to develop in-house battery design and manufacturing.

First-principles thinking in practice meant questioning everything. To cut costs, Tesla changed the cylindrical cell size, simplified the decades-old wet coating and drying steps, and redesigned cells and manufacturing processes.

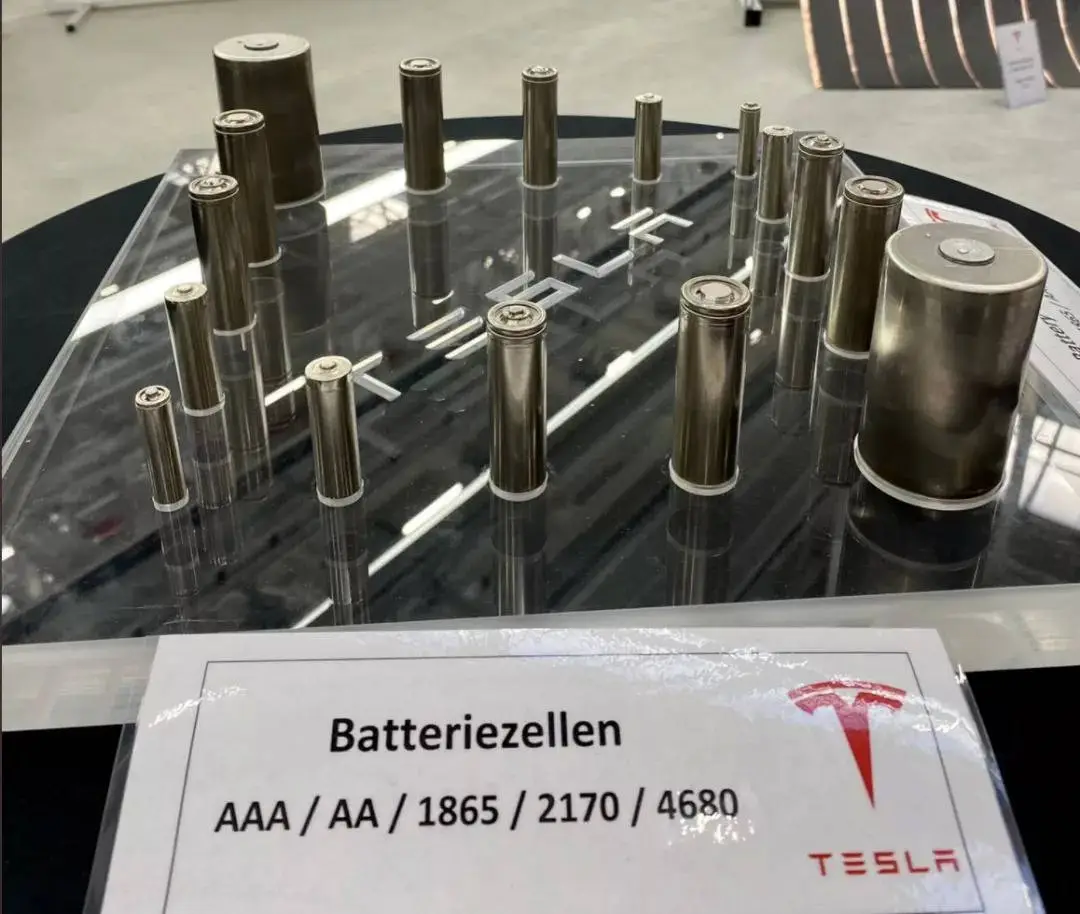

Tesla chose a large-format cylindrical cell: it increased the common 21×70 mm cylinder to 46 mm diameter by 80 mm length — hence the name “4680.” Bigger cylinders raise the ratio of active material in each cell and so improve energy density.

This design also balanced manufacturing efficiency and cost. Mainstream traction cells come in cylindrical or prismatic (pouch/rectangular) formats. Cylindrical cells run faster on production lines than prismatic cells: CATL can make 25 prismatic cells per minute while Panasonic can produce 300 of its 2170 cylindrical cells per minute. The downside of cylindrical cells is their round shape leaves gaps when packed into a module, so the space utilization is lower than prismatic cells.

Large cylinders greatly reduce those gaps. A battery R&D leader told us that a diameter between 45 and 50 mm best balances capacity and space utilization; making cells larger than that raises processing difficulty while delivering diminishing returns in volume efficiency.

“Bumping up the size” looks like a small tweak, but it triggers a cascade of trade-offs. Larger cells force the tabs — the conductive parts that connect the inside of the cell to the outside — to carry higher currents, increasing the risk of thermal runaway and safety concerns.

“If the tab won’t behave, just get rid of it,” Musk said. Tesla removed the tab and turned the whole cell bottom and casing into the conductor — the “full tab” or “tabless” design. That speeds charging and improves heat dissipation: the cell casing has a much larger surface area than a tiny tab, so it sheds heat more easily.

For thirty years battery makers used a wet process: mix active materials with toxic binders and liquid solvents, coat them onto thin foil, then bake the coated electrodes in ovens up to 90°C along lines as long as 100 meters for about 12 hours to evaporate solvents — a costly, time-consuming process. Tesla argued that’s inefficient: if the electrode must be dry in the end, why wet it and then bake it? Wet coating and the equipment, labor, and factory space it requires account for 22.76% of battery manufacturing costs.

In February 2019 Tesla bought Maxwell — a maker of supercapacitors — for $219 million, and adapted Maxwell’s dry electrode technology to lithium batteries, producing dry electrode sheets directly.

Dry electrodes don’t use liquid binders, so they don’t need long ovens. Theoretically they’re cheaper, faster to make, and kinder to the environment. Musk said the process alone could cut equipment spend per unit capacity by a third and reduce electrode shop floor area and energy use by 90%.

Today, a typical prismatic cell line costs around ¥170 million to equip, while a 4680 line was projected to cost only ¥50–60 million.

Tesla also wanted to speed up the battery line. Musk envied beverage and paper plants, where lines run continuously: a beer bottle doesn’t leave the line until it’s capped. Battery manufacturing, by contrast, often has pauses — parts get moved by carts between workshops. The fastest battery lines run about 6 km/h, while the fastest beer lines reach 30 km/h.

Tesla consolidated many battery processes into single machines. In 2021, its Berlin plant deployed a combined cutter-wind-weld machine that used to require three separate pieces of equipment.

As Musk said in 2020, the full 4680 plan could reduce battery manufacturing costs by roughly 20%, cut capital expenditure on equipment by 35%, and shrink factory footprint by 70%.

Tesla saw 4680 as the backbone of a major expansion: cheaper-built battery plants to supply automotive and energy storage cells, enabling a $25,000 car that would boost sales and profits, feeding more R&D and capacity investment — a growth flywheel aimed at selling 20 million cars a year by 2030.

Perfect Design, Difficult Manufacturing

Making bigger cells and removing the wet-coating/drying “idiocy” sounds obvious, but no one in the battery industry had actually done it at scale because it’s hard.

The first big challenge is process transformation.

Automotive assembly is relatively short and tolerant — you largely assemble parts into a finished vehicle and tweaking one station rarely breaks everything else. Battery manufacturing is different: each step’s output is the next step’s input. Change one process and you must change many others.

To use dry electrodes and eliminate drying, Tesla had to make half of the battery flow “dry,” and those dry steps demand far tighter environmental and precision controls than the rest of the line.

Wet coating’s core is the coating step — like spreading cream, a slurry with binder is evenly spread on metal foil at a thickness of about 30 microns. CATL and other firms pushed coating speeds and can now coat 100 meters per minute. As speed rises, quality control becomes harder; those gains come from billions of small experiments.

Dry electrodes also have to deposit active material onto foil, but now the active material is a dry powder with low adhesion. Instead of spreading cream, it’s like sprinkling sand but still needing evenness and speed.

Tesla developed new binders to fix that problem. In 2020 Tesla filed a patent for a dry-electrode binder that improves on PVDF binders. At the microscopic level the binder fibrillates under rolling pressure and forms a net-like structure — akin to turning a flat sand scatter into “sand on marshmallow,” as one dry-electrode expert put it.

But Tesla didn’t initially know the optimal binder amount: too much binder reduces active material and energy density and impedes lithium-ion transport (hurting cycle life); too little and the powder won’t stick. One crude, practical metric is first-cycle efficiency: how much of the cell’s designed capacity you get on the very first charge/discharge. An engineer who tore down mid-2024 4680 samples said Tesla’s parts hit about 88% first-cycle efficiency, while other partners reached about 85% — still below mass-production norms. Mainstream traction cells today achieve over 92%.

So material R&D solved maybe 20% of the production challenge; the rest is equipment development.

Dry electrode machines must roll the binder into fine fibrous structures with consistent force. In a lab that’s easy; in mass production you need continuously precise, robust equipment. Calendering often requires multiple passes; if you only press once you lack room to tune parameters. Tesla’s patents show a three-roller approach with two passes, but a person close to equipment suppliers said Tesla later increased the number of rollers to seven.

More rollers raise the precision ceiling but also make debugging harder: a tweak on an early roller changes all subsequent settings.

Even a daring, experimental company like Tesla can get stuck in an inefficient loop. There’s no shortcut to tuning machines and processes — it takes repeated trials. And changes ripple through the whole line. Removing the wet-coat-and-dry sequence turned out far harder than Musk expected.

Tesla designed equipment in-house and had lithium-battery equipment companies build it, helping overcome some issues. But one supplier said Tesla supplied core drawings and restricted changes. “The end result was engineers who didn’t fully understand the process and Tesla people who didn’t fully understand equipment. Suppliers spent a long time making usable machines, and the machines still didn’t meet Tesla’s spec,” the person said.

In 2021 Tesla contracted several equipment vendors for 4680 lines; some designs were later abandoned. We heard that a leading battery equipment maker supplied an entire 4680 line and sent a team of nearly 50 engineers to Texas to help optimize it; that team left at the end of 2022.

Welding is another tough point. Old cells have a small tab; 4680’s tabless design requires welding over a much larger area. Bigger weld areas are harder to control: too much energy burns through the material, too little makes weak joints — both scrap the cell.

“Tesla still hasn’t clearly defined what a good weld looks like. They innovated from the top down, but when it came to fine details they left things vague, so they’ve been paying others to help realize the dream,” said an equipment supplier. Tesla also faced yield challenges in laser sealing and other steps.

By the end of last year, Tesla’s 4680 yield was only about 92%. The battery industry estimates you need over 95% yield for costs to fall enough to be commercially attractive.

Tesla’s production speed was also well below expectations. An equipment maker said that earlier this year Tesla’s 4680 line ran at about 85 cells per minute, while the industry had thought 4680 lines might reach 350 cells per minute.

And faster lines only expose more quality-control problems. “Even if you let through only 0.001% more dust or debris, that can short a cell. Labs don’t amplify tiny failure modes, but factories do. You keep discovering new failure modes,” said Drew Baglino, Tesla’s battery lead, at an investor day in March.

The 4680 production scheme still isn’t fixed. “The issue isn’t just production — the design keeps changing. Often a process isn’t even stable before they start the next version,” a Tesla engineer told us.

Only Tesla Would Dare Build Batteries This Way

Industry estimates say that even without dry electrodes, the 4680 cell could cut Model Y battery costs by roughly 8%, roughly a 20% reduction in battery cost. That’s less than Musk’s original target, but it would still be a major achievement that Panasonic or CATL would need at least three years to match.

Tesla insisted on developing the dry-electrode process, even if it meant delaying Cybertruck and its next-generation cars. In Musk’s vision the 4680 wasn’t just for today’s Tesla selling a few million cars a year — it had to support a future selling 20 million cars a year.

Only cheaper batteries can underpin a $25,000 Tesla. Tesla finished vehicle development and cracked larger-scale single-piece casting in March this year; the 4680 cell remains the last stumbling block.

In the auto world, only Tesla would invest ahead of the curve like this and tie its commercial expansion directly to a technical breakthrough. That amplifies both upside and risk.

Tesla’s past successes and current struggles both stem from the first-principles method: throw out industry conventions, question requirements, and rethink things from the ground up. This method works when the obstacle is an old practice that modern tech can bypass. Musk often senses that past limits are gone and pushes through what experienced engineers call “impossible.”

But first-principles thinking can’t transcend the limits of its era. When Tesla’s aims exceed the current state of engineering, the company pays huge amounts of time and money to inch forward.

During Model 3 ramp-up in 2017, Musk tried to replace humans entirely with robots and overestimated automation capabilities. Robots couldn’t even reliably comb wiring. Tesla fell into a capacity nightmare and had to bring workers back to the line to recover.

Battery manufacturing is similarly multidisciplinary and tightly coupled — change one thing and everything else moves. Removing the wet-coating-and-dry step meant reworking mixing, coating, slitting and many other processes from the ground up.

Even if Tesla proves the lab concept, it still must solve mass production and commercialization together. One million cars require billions of cells made repeatedly on the same line with acceptable yield and controlled cost.

Multiple industry insiders predict Tesla will reach large-scale 4680 production in 2025, but the final mass-production version will likely fall short of the 2020 spec. Tesla’s current 4680 energy density is about 265 Wh/kg, nearly 20% lower than the 330 Wh/kg many expected. A Cybertruck using this cell would have a top range of only about 547 km, far below earlier 800 km targets.

From announcement to now, Tesla has achieved maybe one-third of the initial 4680 ambitions in three years, delivering the simpler dry-graphite anode but still facing harder steps like dry silicon anodes and even dry cathodes.

From a brutal commercial perspective, being slow is sometimes unacceptable: Tesla’s product cadence has been disrupted and new models are missing at a time when it should be striking while the iron is hot. From a technology perspective, Tesla has paved a path for the industry: the 4680 standardizes a large-format cylindrical cell, and giants like CATL are now exploring dry-electrode methods and extending the concept to separators and other components. The 4680 may yet spark a technical revolution in traction battery manufacturing.

- Next:CATL's All-Solid-State Battery Enters Sample Verification Phase

- Previous:Tesla Battery Types: A Simple Guide for Model S, 3, X, and Y

Contact Details

Lithium LiFePO4 Batteries and Lithium LiFePO4 Cells Supplier - LiFePO4 Battery Shop

Contact Person: Miss. Elena Wang

WhatsApp : +8615263269227

Skype : +8615263269227

WeChat :15263269227

Email : info@lifepo4batteryshop.com

All Products

- A123 Battery (5)

- Sinopoly Battery (7)

- GBS Battery (16)

- CALB Battery (22)

- Cylindrical Cell (3)

- Energy Storage System (0)

- Battery Management System (2)

- Sodium ion Battery Cell (3)

- Lithium Titanate Battery (16)

- Ternary Lithium Battery Cell (11)

- REPT Battery (8)

- BYD Battery (2)

- CATL Battery (14)

- Thunder Sky Winston Battery (21)

- EVE Battery (29)

- LiFePO4 Battery Cell (4)

Certification

Customer Reviews

- I have fond memories of our meeting in Shanghai with LiFePO4 Battery Shop Elena. Your company left a strong impression on me with its impressive growth and professionalism. We both value straightforwardness and honesty, which I believe are the most important qualities in any partnership. I am confident that we can build a successful collaboration based on these shared values. —— Robert from USA

- I've been working with LiFePO4 Battery Shop for years, and their reliability is unmatched. While other suppliers frequently change sales teams, LiFePO4 Battery Shop has consistently provided exceptional service with a stable team. Their commitment to quality and customer support truly sets them apart. —— Henry from Australia