Blog

Tesla Sprints Toward the “Complete” 4680 Battery: A Final Gamble After Five Years

2025-11-05 | Calvin

We have learned exclusively that Tesla plans to begin mass production of vehicles equipped with fully dry-electrode 4680 batteries by the end of this year. This version would represent the true “complete” form of the 4680 cell.

In 2023, Tesla adopted 4680 batteries in the Cybertruck, but that version was a compromise. It fell short of the original vision: reinventing battery manufacturing by replacing the traditional wet-electrode process with a dry-electrode method, eliminating the wetting and drying stages to speed up production and cut costs. Currently, only the anode uses the dry-electrode process. The more expensive cathode still relies on traditional wet-electrode materials sourced from LG Energy Solution and two Chinese battery suppliers.

Now, Tesla is one step away from achieving the full 4680 technology. We understand that the dry-electrode cathode design has recently been finalized. This marks the step before large-scale production, and Tesla’s battery division is now focused on improving production yield and efficiency while expanding capacity.

Sources say Tesla successfully produced dry-electrode cathode rolls in laboratory settings at the end of 2022. However, due to technical misjudgments, mass production stalled. After project lead Drew Baglino left in April, Tesla shifted its technical direction and achieved a breakthrough in dry-electrode cathode production.

“Once the dry-electrode tech is fully achieved, it will transform Tesla,” said a person familiar with the company.

Introduced in 2020, the 4680 battery was Tesla’s self-developed cell, promising to cut battery costs by 50 percent and deliver more affordable EVs.

The key to major cost reduction lies in the dry-electrode process. Conventional battery electrodes are slurry-based, meaning production requires drying and solvent recovery, which are time-consuming and require large factory footprints. Dry-electrode technology eliminates these steps, significantly reducing space requirements and capital investment per unit of production capacity, while improving cell performance and manufacturing efficiency.

The dry-electrode cathode is the most critical and difficult part of the 4680 process. It also accounts for more than 35 percent of total battery cost.

Meanwhile, Tesla is still improving the packaging and material mix of the current compromise 4680 cells, which are prioritized for the Cybertruck. Right now, Tesla’s weekly 4680 output is only enough for about 1,000 Cybertrucks.

Sources say that among suppliers for 4680 materials currently produced in the US, Chinese firms are almost gone. Some production equipment has been switched to Japanese, European, and American suppliers, and Tesla is seeking alternatives for remaining equipment sourced from China.

At the same time, LG Energy Solution is expected to begin supplying fully wet-electrode 4680 cells in the second half of the year for US-built Model Y vehicles.

The 4680 cell is central to Tesla’s competitiveness in next-generation products, and the dry-electrode cathode is the core of that effort. Tesla has now spent five years on this project.

After Solving R&D Bottlenecks, Engineering Optimization Comes Next

The rule of manufacturing success is simple: build better products with less money.

Over the past five years, Tesla pursued a clear path to efficiency: giant gigacasting machines for faster body production, simplified next-generation vehicle designs, dry-electrode battery manufacturing, unboxed vehicle assembly, and more efficient gigafactories.

Billions of dollars and huge engineering efforts went into these innovations. Achieving them would help Tesla maintain industry-leading margins and operational efficiency, as it did three years ago.

But since April, Tesla has paused several initiatives: the $25,000 entry-level car, larger gigacasting plans, and construction of the next-gen Mexico gigafactory.

The 4680 cell also looked uncertain. In April, Drew Baglino left after 17 years at Tesla, and about 25 percent of the battery team was cut, leaving fewer than 800 employees.

Earlier this year, Tesla reportedly told the battery team their KPI was clear: if by year-end Tesla’s 4680 battery costs cannot beat those of LG and Panasonic, the in-house 4680 program would be reconsidered. And beating LG’s cost would mean building the cheapest US-made battery.

Recent breakthroughs in dry-electrode cathode production make the year-end goal more realistic. After Baglino’s departure, Tesla pivoted to a path with slightly higher cost but faster manufacturability.

Although Tesla produced dry-electrode cathode rolls in labs in 2022, scaling production proved difficult. The biggest challenge came during the rolling process. The cathode powder is extremely hard and sometimes damaged equipment. Elon Musk mentioned on a 2022 earnings call that this issue was unexpected.

One engineer familiar with the project said Tesla had only a few custom dry-electrode rollers, and each failure could take 45 days to repair.

Internally, Tesla debated whether to move some engineering issues downstream past the rolling and winding stages. This would require equipment changes and extra cost and was initially rejected. The battery team has now adopted that approach and seen progress.

According to insiders, confidence has grown because the hardest technical hurdles appear to be behind them, and remaining tasks involve engineering refinement and incremental optimization.

For example, when defective electrode sheets appear, typical battery makers cut tens of centimeters of material. Tesla cut several meters, losing more material and making troubleshooting harder. Tesla lacked engineering manpower for testing, but now basic technicians will handle more of the workload.

“The path is clear now. It just takes time,” a Tesla source said.

Tesla May Soon Reduce Reliance on External Battery Suppliers

Before the 4680 program, Tesla never fully manufactured its own batteries. Panasonic produced cylindrical cells, and starting in 2020, Tesla’s supply chain stabilized: CATL supplied prismatic LFP batteries for standard-range models, and Panasonic and LG supplied cylindrical cells for long-range and premium models.

With the 4680 ramp since 2023, Tesla has begun reducing reliance on external suppliers, including Chinese companies. Current compromise-version 4680 cells made in Texas use LG and Chinese wet-electrode cathodes plus Tesla’s dry-electrode anode.

If Tesla scales dry-electrode cathodes successfully, it can fully produce 4680 cells in-house. Suppliers would lose part of Tesla’s future demand. Musk once envisioned Tesla making at least 30 percent of its own batteries.

Chinese firms could still provide equipment, although Tesla has not yet adopted Chinese machinery for core dry-electrode processes, instead favoring Japanese and German suppliers.

Whether Tesla can maintain cost leadership remains uncertain. It depends on yield improvement and scaling speed. If yields stay low, the savings from eliminating drying steps might be erased.

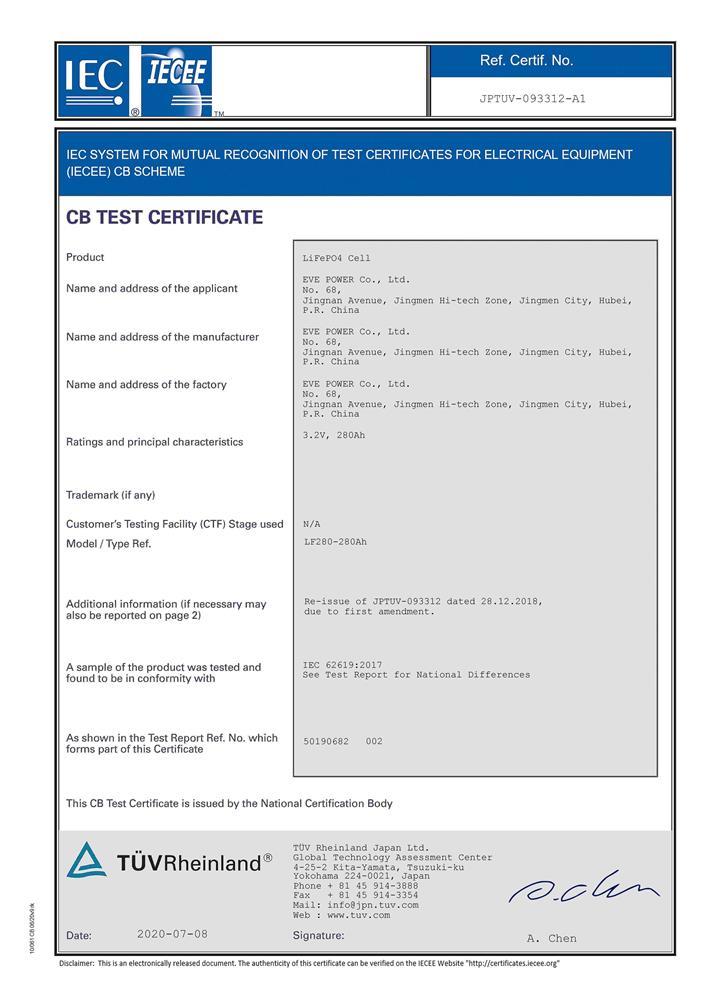

Meanwhile, competitors like LG, Panasonic, and EVE Energy are also developing 4680 cells and dry-electrode tech. CATL, despite skepticism about 4680, is also researching dry-electrode processes. Eventually, Tesla will face renewed manufacturing competition when others catch up.

At the same time, CATL and BYD continue driving down costs, with current battery costs around 0.33 RMB per Wh, still the lowest globally.

Tesla is also deepening collaboration with CATL. Early this year, they began co-building an LFP energy-storage battery plant in Nevada, with CATL selling production lines and providing technical support for a licensing fee.

- Next:Everything You Need to Know About Cylindrical Batteries

- Previous:Tesla Battery Types: A Simple Guide for Model S, 3, X, and Y

Contact Details

Lithium LiFePO4 Batteries and Lithium LiFePO4 Cells Supplier - LiFePO4 Battery Shop

Contact Person: Miss. Elena Wang

WhatsApp : +8615263269227

Skype : +8615263269227

WeChat :15263269227

Email : info@lifepo4batteryshop.com

All Products

- A123 Battery (5)

- Sinopoly Battery (7)

- GBS Battery (16)

- CALB Battery (22)

- Cylindrical Cell (3)

- Energy Storage System (0)

- Battery Management System (2)

- Sodium ion Battery Cell (3)

- Lithium Titanate Battery (16)

- Ternary Lithium Battery Cell (11)

- REPT Battery (8)

- BYD Battery (2)

- CATL Battery (14)

- Thunder Sky Winston Battery (21)

- EVE Battery (29)

- LiFePO4 Battery Cell (4)

Certification

Customer Reviews

- I have fond memories of our meeting in Shanghai with LiFePO4 Battery Shop Elena. Your company left a strong impression on me with its impressive growth and professionalism. We both value straightforwardness and honesty, which I believe are the most important qualities in any partnership. I am confident that we can build a successful collaboration based on these shared values. —— Robert from USA

- I've been working with LiFePO4 Battery Shop for years, and their reliability is unmatched. While other suppliers frequently change sales teams, LiFePO4 Battery Shop has consistently provided exceptional service with a stable team. Their commitment to quality and customer support truly sets them apart. —— Henry from Australia