News

2025 China's New Lithium Battery Export Regulations: Regulation ≠ Ban

2025-10-14 | Calvin

On October 9, the Ministry of Commerce and the General Administration of Customs issued Announcement No. 58 of 2025, bringing certain lithium batteries, high-end anode and cathode materials, and core manufacturing equipment under export control. This marks the first time that lithium battery manufacturing equipment has been explicitly included in the control list.

The announcement emphasized that export control does not equate to a ban; companies can still conduct export operations through a licensing process. The move mainly targets high-end technologies and core equipment for regulation, rather than blocking overseas markets.

In the medium to long term, the lithium battery industry chain is a strong suit for China. Moderately controlling the outflow of high-end products and production capacity not only protects core technologies but also helps prevent small enterprises from uncontrolled expansion overseas and technology leakage.

Under the new regulatory framework, top companies with compliance capabilities and global operational experience may actually gain more stable overseas market shares and better profitability.

Short-Term Impact Limited, Long-Term Value Differentiation

The announcement covers three main categories:

- Lithium batteries (cells, modules, packs): Energy density ≥ 300Wh/kg. This mainly applies to high-end electric vehicles, flying cars, electric aircraft, specialized drones, military equipment, and advanced energy storage batteries. Conventional consumer electronics batteries are not affected. Currently, only a few companies can mass-produce batteries with energy density ≥ 300Wh/kg, and even fewer for export, so most companies are unaffected in the short term.

- Battery manufacturing equipment and technology: Primarily critical cell-level equipment (winding machines, stacking machines, filling machines, hot presses, formation and grading systems, grading cabinets, etc.). Module and pack manufacturing equipment are not controlled, and overseas impact is limited.

- Cathode and anode materials and related manufacturing processes: Includes high-end materials and production techniques such as artificial graphite, high-density lithium iron phosphate, lithium-rich manganese-based materials, and ternary precursors.

Exporters of these items must apply for a license from the Ministry of Commerce. The approval cycle is approximately 45 working days. A dedicated approval channel will open in early November, and companies can consult provincial commerce departments.

Industry leaders generally believe the short-term impact is limited. For example, lithium battery equipment manufacturer Li Yuanheng mainly exports equipment through domestic clients’ customs procedures, so direct impact is minimal. Meanwhile, the policy’s “hard constraints” make localization more valuable, and early movers can quickly convert this into market advantage. Li Yuanheng has production bases in Poland and Canada, enabling localized production and direct supply to European clients, reducing delivery costs while meeting compliance requirements.

Lithium battery technology has evolved from an industrial advantage to a national strategic resource, temporarily increasing compliance costs but pushing the industry chain toward a healthier, more localized, and strategically controlled development path in the long term.

Lithium Battery Technology Reaches Strategic Level

The background of this policy reflects the growing strategic significance of lithium battery technology in domestic and international industrial patterns.

On the one hand, in terms of scale, lithium batteries have become one of China’s most globally competitive industries. Customs data shows that from January to August 2025, China exported 3.003 billion lithium-ion batteries, up 18.66% year-on-year; export value reached $48.296 billion, up 25.79%.

On the other hand, in terms of technology, although China is not the largest lithium resource producer, it is the world’s largest lithium processor and consumer, mastering core segments like lithium iron phosphate (LFP) and ternary precursors. Amid the global energy transition, the strategic importance of LFP batteries has risen rapidly, and domestic protection of advanced technology has strengthened.

This is not the first tightening of relevant exports. In July, the Ministry of Commerce and Ministry of Science and Technology adjusted the “Catalogue of Prohibited and Restricted Export Technologies,” including cathode material preparation and lithium extraction technologies. LFP and LMFP preparation techniques were explicitly listed, with indicators closely aligned with industrial-scale production.

These adjustments signal that the policy aims to help domestic industries lock in technological benefits, extending China’s lead in the lithium battery sector.

Additionally, the AI wave is driving higher energy demand. The evolution of AI data centers (AIDC) places greater demands on electricity consumption and energy storage. GGII predicts that from 2024 to 2030, the global data center energy storage market will grow 12-fold. CATL also forecasts that by 2030, energy storage battery shipments for data centers will reach 300 GWh, representing a $15 billion market.

In the context of global competition, batteries have risen from supporting new energy transitions to becoming the “digital oil” of the AI era. With rapidly growing AI and storage demand, the battery industry is now a focus of global energy policy. The policy carries both industrial-economic and geopolitical significance.

Overseas demand for batteries is strong, but the core segments of the industry chain remain weak. The US “Inflation Reduction Act” in July cut subsidies for wind, solar, and EVs, while imposing source restrictions, but implemented a relatively relaxed exit mechanism for energy storage batteries. The US still faces explosive electricity demand from AI and continues to need imports of energy storage batteries. The US remains China’s second-largest lithium battery export market, with exports totaling $7.418 billion from January to August, accounting for 16.8% of China’s lithium-ion battery exports.

Official Interpretation: Dual-Use and International Norms

The core intent of the policy is to strengthen management and protection of sensitive technology while maintaining industrial competitiveness, national security, and compliance with international norms. Currently, mainstream liquid batteries have energy densities around 260Wh/kg and are outside the control scope. Future solid-state batteries are expected to exceed 300Wh/kg, hence the focus on high-performance frontier products and processes.

A spokesperson for the Ministry of Commerce clarified that listed items have clear dual-use (civilian and military) characteristics. Export control is legal, compliant, and fully in line with international practice. High-energy-density lithium batteries, especially those ≥ 300Wh/kg, have applications in EVs, military drones, individual soldier equipment, underwater vehicles, and more, with significant national security implications.

Regarding concerns about targeting specific countries, the spokesperson stated that these measures do not target any nation or region, noting that export controls on dual-use technology are common internationally.

Rising Compliance Threshold and Localization Value

In the short term, market impact is limited:

- Battery side: mainstream export products are below the control threshold and unaffected.

- Materials side: LFP and graphite anode exports have low share; short-term impact is minor.

- Equipment side: customs and approval costs rise, but export channels remain.

In the medium to long term, as compliance requirements rise, reliance solely on domestic exports becomes uncertain, while building overseas factories and localized delivery becomes more valuable. Companies like CATL, EVE Energy, Gotion High-Tech, Lishen, and Li Yuanheng, which have production in Europe, Southeast Asia, and North America, are expected to gain stability in the new environment.

For example, Li Yuanheng has actively expanded global operations and service networks, establishing branches in Europe and North America, and production bases in Canada and Poland for localized manufacturing and delivery. Overseas bases allow direct supply to clients, reduce costs, and meet domestic clients’ overseas expansion needs. In 2025, localization has already yielded results: Li Yuanheng won a module pack line order from a Czech energy storage company, achieving 150 PPM peak capacity, 99% utilization, 99.95% yield, and <2% failure rate. Its R&D, engineering, and precision manufacturing leadership has begun taking root overseas.

Li Yuanheng also partnered with a Polish commercial vehicle battery company, signing a global strategic cooperation agreement covering power and energy storage technologies, equipment, and smart factories. Its Polish base can deliver complete power battery module, pack assembly and testing lines, and motor assembly lines, gradually increasing overseas market share.

The company intends to continue global operations with localized service, leveraging overseas resources for sustainable solutions while strictly complying with export regulations.

Conclusion

This export control upgrade signals that lithium battery technology is no longer just an industrial advantage but a strategic resource in global competition. Short-term, it increases compliance costs; long-term, it will drive the industry toward a healthier, more localized, and strategically controlled development. Companies with overseas production capacity face both challenges and opportunities to validate forward-looking investments and gain competitive advantage.

Ultimately, beneficiaries will be leading companies that continuously invest in high-end technology breakthroughs, localized operations, and optimized client quality. As a representative in the equipment sector, Li Yuanheng is leveraging overseas localization, new process innovation, and client structure optimization to emerge from industry lows and secure a stronger position in the next wave of global industrial opportunities.

- Next: Great Power Shines in the UK! Great Power 2024 Energy Storage Products Win Over European Customers

- Previous: Sunwoda’s Consumer Semi-Solid-State Battery Production Exceeds 8 Million Units

Contact Details

Lithium LiFePO4 Batteries and Lithium LiFePO4 Cells Supplier - LiFePO4 Battery Shop

Contact Person: Miss. Elena Wang

WhatsApp : +8615263269227

Skype : +8615263269227

WeChat : 15263269227

Email : info@lifepo4batteryshop.com

All Products

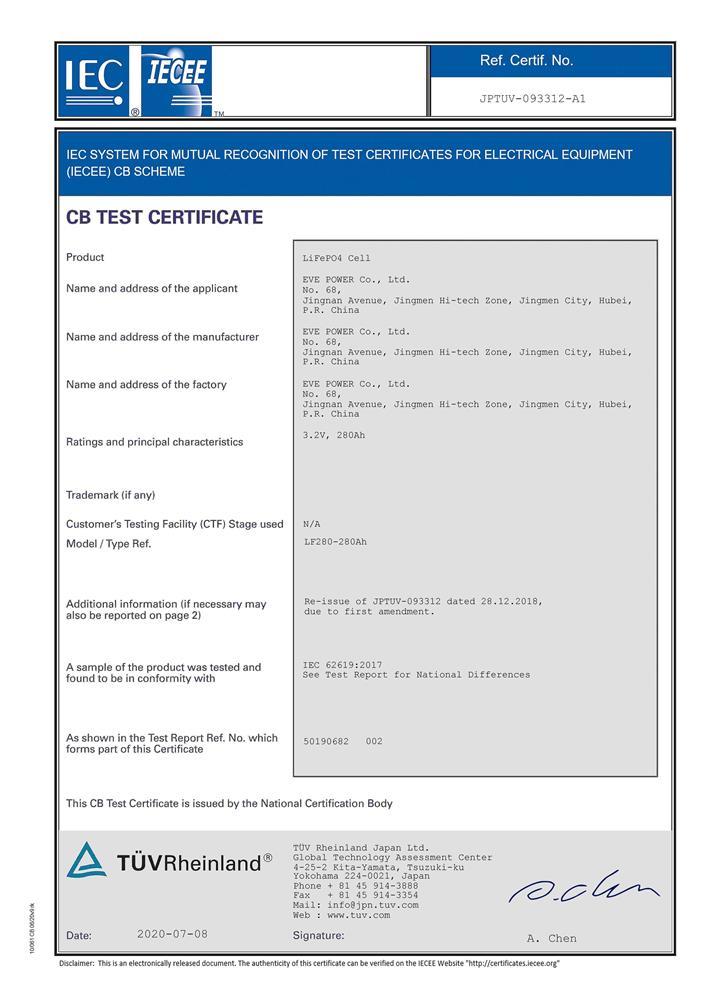

Certification

Customer Reviews

- I have fond memories of our meeting in Shanghai with LiFePO4 Battery Shop Elena. Your company left a strong impression on me with its impressive growth and professionalism. We both value straightforwardness and honesty, which I believe are the most important qualities in any partnership. I am confident that we can build a successful collaboration based on these shared values. —— Robert from USA

- I've been working with LiFePO4 Battery Shop for years, and their reliability is unmatched. While other suppliers frequently change sales teams, LiFePO4 Battery Shop has consistently provided exceptional service with a stable team. Their commitment to quality and customer support truly sets them apart. —— Henry from Australia